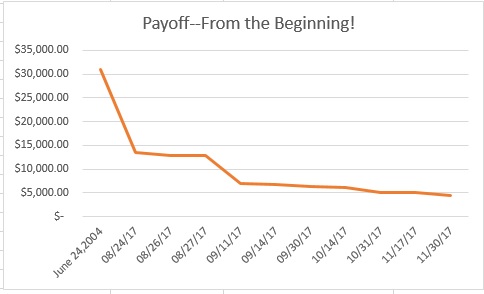

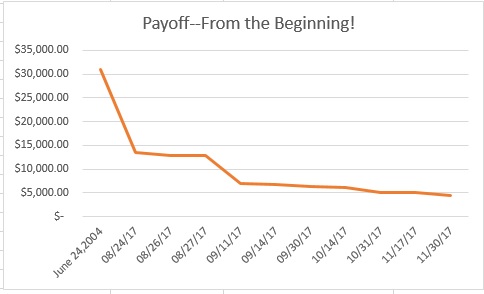

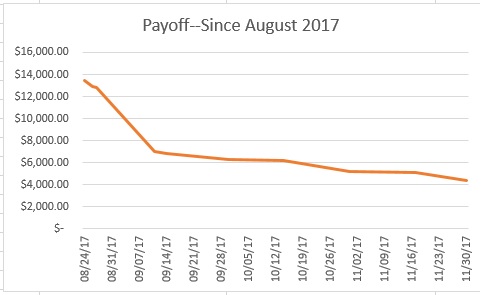

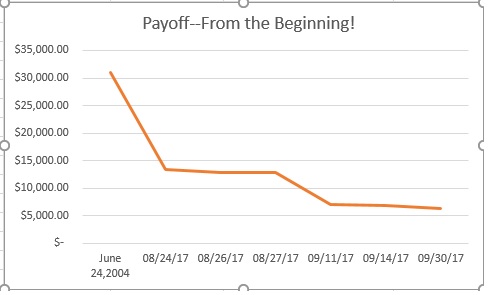

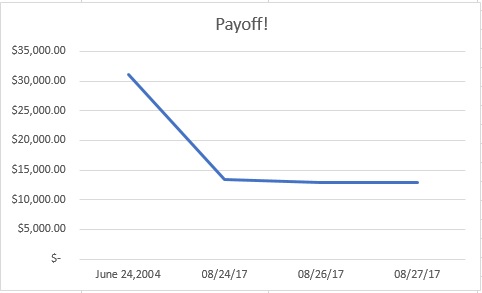

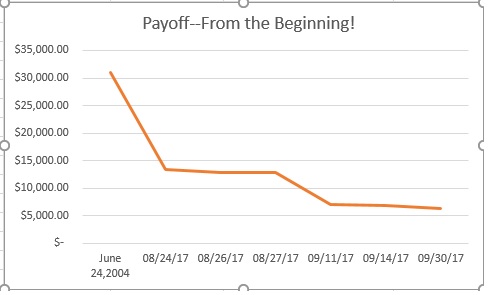

In looking for ways to send more of my money toward the payoff of my student loan, I’m going to focus on reducing my food costs in the last three months of 2017

There are many different ways to look at food costs. Some people lump their grocery and eating out budgets into one line. Some people look at the amount for the entire month, while others look at their food budget weekly. Some people even will break down each meal into a cost.

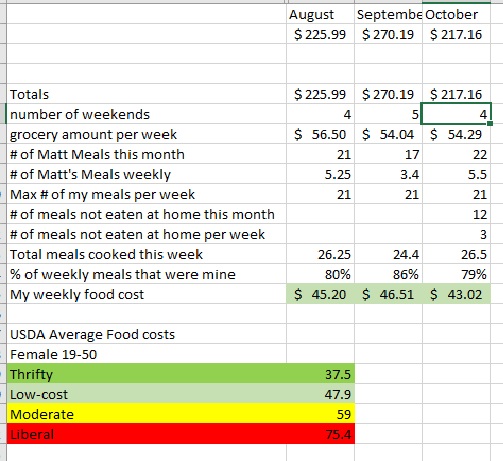

I have a couple of complicating factors in tracking my grocery bill. One has to do with the calendar. There are 30 days in some months, 31 in others. Some months have four weekends, some have five. Also, I make and sell meals to Matt. This came about because I needed a side job, and one of my skills is cooking. He has no desire to develop that skill in himself (thus far) and needed to reduce food costs. This has been great for both of us. For me, it’s easier to make recipes that feed more than one person. Plus, I get a little extra cash on the side. Matt gets a variety of nutritious food for less than he would pay eating out. I charge him $4.10 per meal.

A few years ago, I was searching the internet to find out what is a reasonable amount to spend on groceries. I discovered the USDA’s Food Plans. In a delightful bit of government minutia, food costs are tracked monthly and published on the USDA website. In one handy PDF document, you get food costs broken down by age, gender and family. Plus you can see the average cost under four USDA plans broken down weekly or monthly.

Example: For August 2017, a female between the ages of 19 and 50 would find the weekly/monthly Thrifty Food Plan costs to be $37.90/$164.20; the Low-Cost Plan to be $47.90/$207.50; the Moderate-Cost Plan to be $59.00/$255.80; and the Liberal Plan to be $75.40/$326.70. Note that these plans assume all meals and snacks for the week/month are prepared at home.

This is super cool and gives me a goal. Except, I also have to somehow reflect the fact that 4-6 meals worth of food per week go to a male between the ages of 19-50 years old (Thrifty food cost for that category is $42.80/$185.40). What to do, what to do?

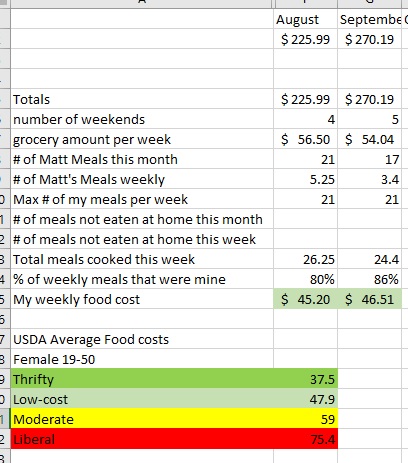

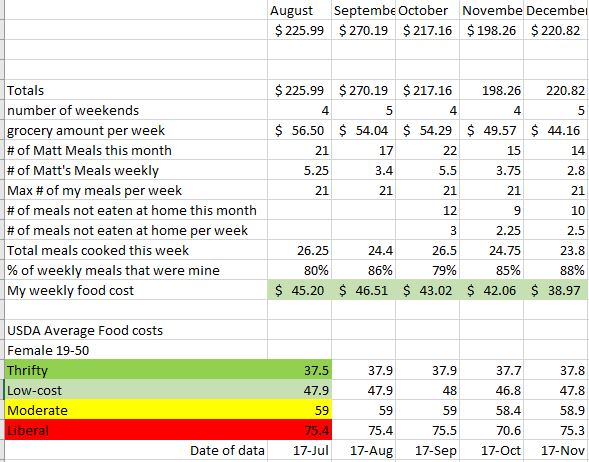

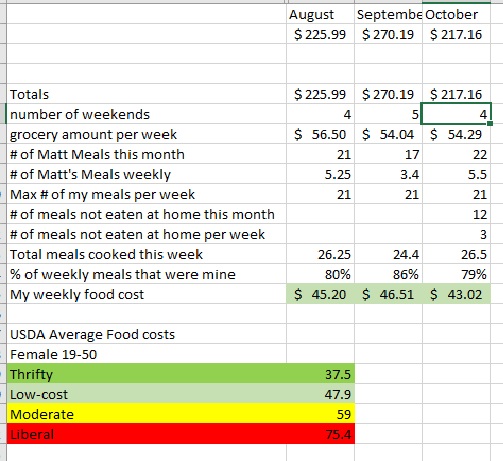

I went back and crunched my grocery numbers from YNAB. There’s a whole spreadsheet, but I won’t make you read that. I’ll just sum up what I found.

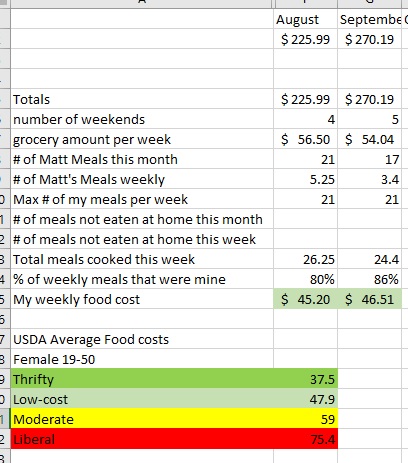

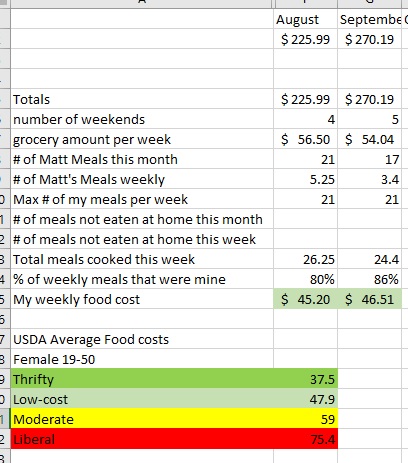

First of all, I decided that the grocery shopping week begins on Saturday. I do my shopping on Saturday or Sunday. Thus, months that have five weekends, the total monthly food cost gets divided by 5. (Of course, October is the rare unicorn and begins on a Sunday, making things complex. I gave September 5 weekends, and October 4)

From April through September my average weekly food costs were $64.97 which puts me above the Moderate and below the Liberal Plan. Drat! Although August & September took a deep dive with $56.50 and $54.04 weekly totals.

But! Some of those food costs went to meals for the 19-50 year-old male. I don’t have data prior to August, but in August I sold Matt 21 meals and in September there were 17. (Vacation happened.)

I took the average number of Matt’s meals per week and added them to the total number of meals per week for me (7 days times 3 meals per day gives me 21 per week) giving me a total of 26.25 meals per week in August.

After that, I figured out what the weekly percentage was for my meals. In August that was 80%. Using that percentage, I could then calculate my actual average weekly meal costs. My total: $45.20 which puts me below the $47.90 Low-cost plan but not reaching the threshold of $37.90 Thrifty food plan.

I’ve realized there is a slight flaw in my data in that I don’t actually know how many meals I ate in the month. As mentioned before, vacation happened and the food budget for vacation happens outside of this grocery budget. I also don’t know how much I ate out in August, or September. Though my $40 eating out budget remained untouched all month (good job, me)a friend did buy me lunch for helping her with her resume. Plus work bought at least two lunches.

I have added lines to my spreadsheet so I can more accurately reflect the number of days I ate meals that I prepared.

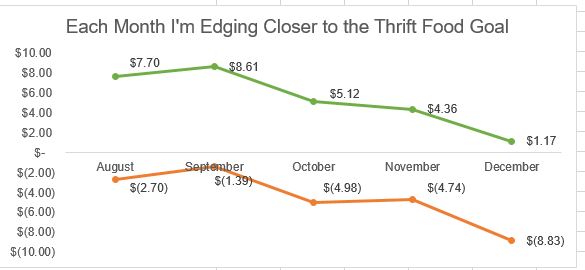

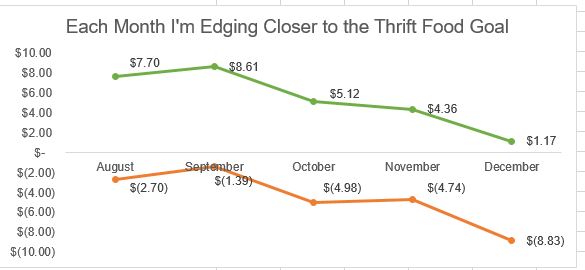

My goal for October, November, December is to meet the Thrifty Plan Food costs while still eating a variety of delicious food with a lot of fruits and vegetables. I still plan to buy my red meat and poultry at New Seasons, which costs more, but I hope to offset that by doing the bulk of my shopping once per month at Winco (I have rediscovered the amazing deals) and cooking more with low-cost ingredients as well as using meat and cheese as flavor enhancers and not the main event. I will also figure out a way to better ascertain if Imperfect Produce is a good enough deal to keep going with.

Right now, I’m pleased that my grocery costs are in the Low-Cost range. But the monthly difference between the Low-Cost and Thrifty plans is $43.30. Over one year that is $519.60 that would be better off being paid toward my student loans.