This mobile bartender, the most rock-and-roll guy at the concert.

One of our many crippling snows.

Container ship in fog over from the Steel Bridge

Blue sky and the White Dove of the Desert

Tourists at White Dove of the Desert

Pride 2017. Portland.

Portland Actors Ensemble

Total eclipse 2017. (No filter)

Seaside sunset

Minnesota State Fair

Paul at the Minnesota State Fair

SkyGlider, Minnesota State Fair

Spoonbridge and Cherry, Minneapolis Sculpture Garden

Tag: me

Changing of the photos

Each year when I order my Christmas cards (and, increasingly, Christmas presents) via Shutterfly, I also have some photos printed. When they arrive, there is a changing of the guard.

I first print a “fun” set of things that happened the previous year. This goes in my photo mobile. It’s tricky to get an even number of portrait and landscape photos, but I persist until I find a good combination.

I also have a photo collage frame in my bedroom, where I feature 10 “good” photos I took the previous year. You’ll see these photos again in a “best photos” post at the end of the year.

It’s tradition to have at least one concert photo per year featured in the photo collage. This year, I’m proud to say the guy selling water is my concert photo. I also apparently ordered 13 photos, not 10, so the three on the right didn’t make the cut.

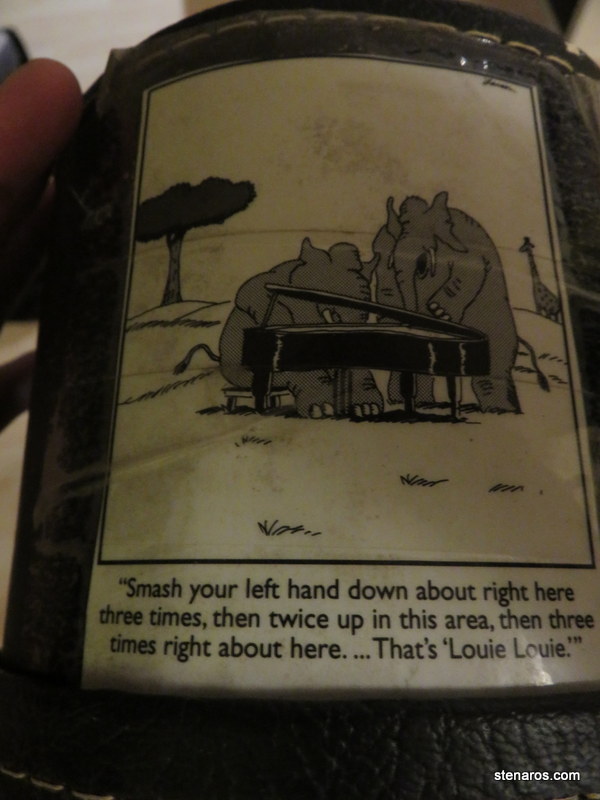

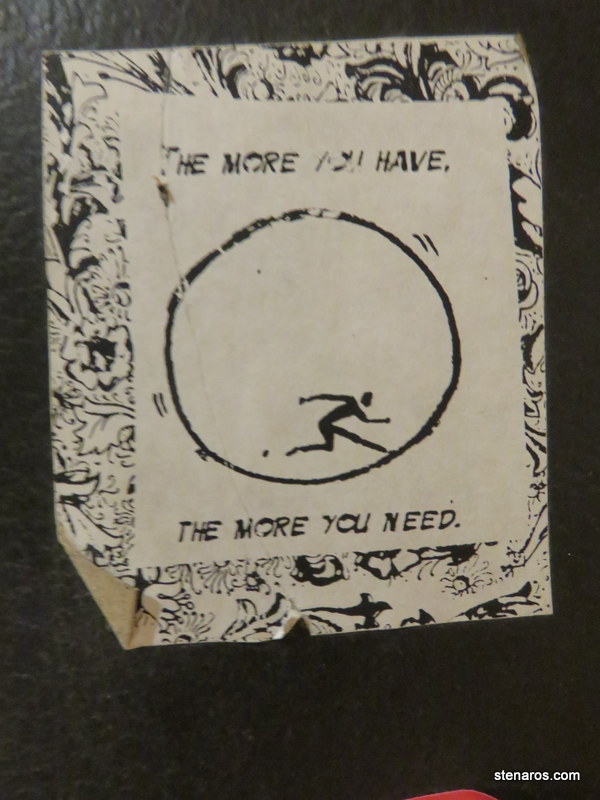

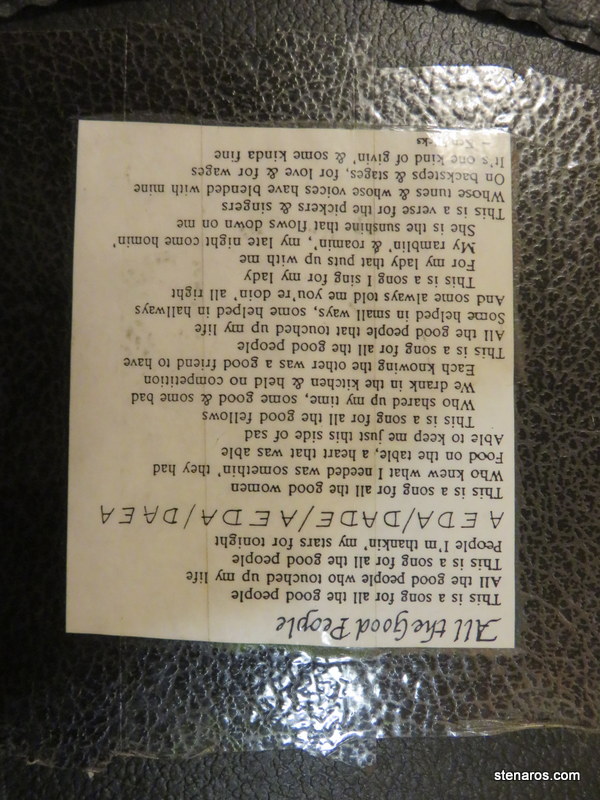

Stickers on my guitar case

Back when I got the Forty Dollar Guitar, I also got this case. I immediately set out to cover it in stickers, because that was the cool thing to do. Here’s a retrospective. (To simulate the full effect, I didn’t rotate any of the photos, so some of them are upside down.)

One of my favorite Edward Hopper paintings, also featured in the movie Singles as a title card. (Alas, blurry picture.) Internet research for said title card has turned up nothing. Instead, I found this really great Rolling Stone interview with Cameron Crowe which told me that Pearl Jam bassist Jeff Ament got a job in the art department for the movie, and it was his handwriting that was featured on the title cards.

College part II

I do not remember the origin of this sticker.

My roommate Erin Feldman made these in college. I had one on my sewing machine, and when I took it in for repair, the scrubbed it off without asking. Not cool. This is the surviving sticker.

Gotta have V. Mars.

Boise band. Also fond memories. I still have the t-shirt.

From our first visit.

TriMet swag.

My first Public Radio Station

More TriMet swag.

This bumper sticker is often seen in the Boston area. When I climbed Mt. Monadnock, I made sure to buy the sticker.

This cracked me up when I saw it on a car, so Matt bought me my own copy for my birthday.

My first without-parents vacation.

I’ve been several times. This might be from my visit with Jan and Kelly.

He wasn’t my guy, but I admired him. And I liked the alliteration.

Rebuilding Center.

One of the more recent, from my February visit to Arizona.

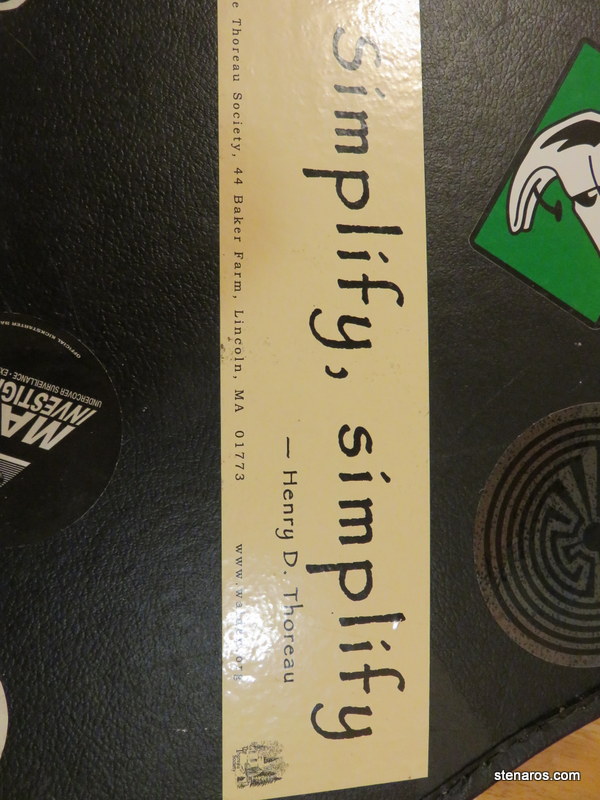

My mom brought me this from a Massachusetts trip.

More V. Mars. These are from the movie kickstarter.

This came from College part I, I think.

If you live in Oregon, it’s good to have this sticker.

College part I

Also from College Part I, this was a song that we sang a lot my second year there. I’ve never heard it in its original form, but we had our own tune. (This was before you could find ALL THE SONGS on the internet. If you had no recording and no sheet music, you were out of luck, or made up your own tune.)

From an “insider” tour.

My brief foray into thinking this computer manufacturer was for me.

I think this was another NOW sticker. Sorry feminist sticker, you didn’t hold fast.

Restaurant in Fort Collins?

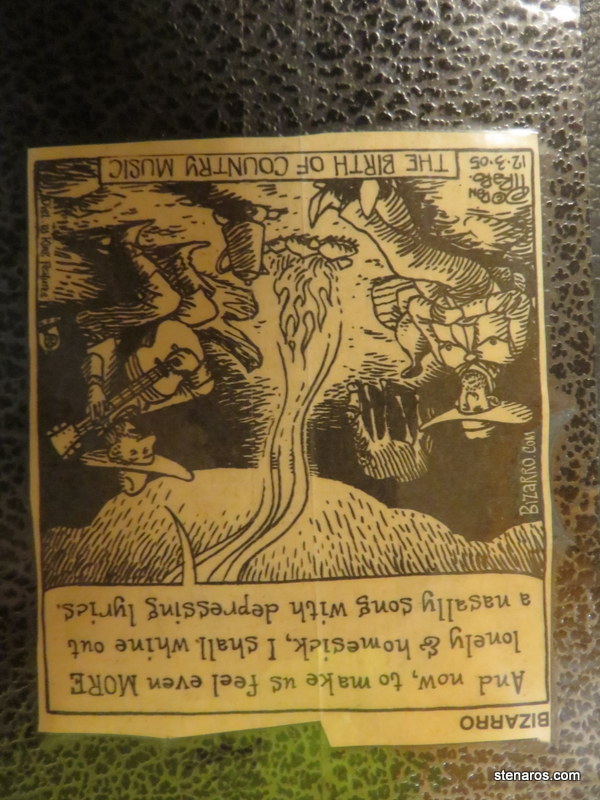

When I was selling the guitar, one of the store employees laughed at this one.

College part I, back when the focus was on girls.

Overall views.

The Orange Door: Guitarless

In the spring or summer of 1989 my mother drove us to a music shop on Chinden Boulevard, where she paid $40.00 for an acoustic guitar. (It may have been $60, but for years I’ve called that guitar the Forty Dollar Guitar.)

She bought me the guitar–and also lessons–so that I could be in ninth grade Jazz Band, playing jazz guitar. When it came time to pick who was going to be in Jazz Band, there was another guy who was very good at the guitar and would have made a great addition to the West Junior High Jazz Band. But he refused to take both Concert Band and Jazz Band. I said I would take both, and thus I became the jazz guitarist. This was a terrible idea, as I’m not the kind of person who can go from no knowledge of an instrument to jazz-level competence over a few months. We placed last at the 1990 Lionel Hampton Chevron Jazz Festival, though I like to think I wasn’t the only cause.

After that failure, I picked up the guitar intermittently. My musical talent includes learning new instruments quickly, progressing to a certain point of mediocrity, and then going no further. I played a lot in 1995, when the transition between College Part I and II didn’t go as smoothly as I wanted. And I made a full push to really learn this guitar, dammit, in 2006, even taking lessons and practicing regularly. That’s when I bought the current guitar. That push ended when we bought the house in 2007.

I have fond memories including guitars. There was my introduction to Rise Up Singing, that day at Cottey when Jennifer Comeau got out her guitar and we sang together in the parlor. The year my boss turned 50, we had a summer plan to assemble a songbook for her 50th birthday party. Daily, we got out our guitars and worked through songs, getting the song in the best key for singing and the chords in the right place for people to play along with. We used the forty dollar guitar for a couple of years when we sang every day at 10am. She would play and we both would sing.

And that’s the problem. I never really took to the guitar. I think I’m a horizontal musician, not a vertical one. When you learn chords on the piano, there is a straight line of keys laid out before you, and it’s easy to see how they are formed, and easy to move up or down an octave. On the guitar, you first learn the pattern your fingers take, then maybe eventually the notes that make up the chord.

Also, with a guitar, when you want to play you have to remove your instrument from a box (or hook, or stand) and fiddle with it to make sure it’s in tune. When you go to play piano, you just sit down. For some reason, those extra steps were more of a barrier to practice.

I never got good enough at the guitar so I could play and sing at the same time. And since I love singing more than guitar playing, it made sense to let the guitar go. Even knowing that, it was hard to do. I still have the fantasy of an impromptu jam session breaking out in the living room. But it’s been 10 years, and that hasn’t happened yet, so it’s time to let the guitar go.

Here’s to admitting something isn’t going to become my thing.

New clothes drying rack!

Aside from the money that went to the Payoff! goal, I spent my birthday money on this fabulous clothes dryer.

I’ve re-committed to air drying my clothing since discovering Mr. Money Mustache. In the summer, this is low-key. My outdoor rack is huge, and fits everything nicely. It very rarely rains in the summer, so I don’t have to plan around that. But now we are not in the summer and are endlessly damp. It’s either raining, just finished raining, or is about to rain.

I already have indoor racks, but they aren’t quite enough for both sheets and clothing. Enter this rack. Underwear, socks, washcloths and small towels will go on this. Maybe some t-shirts too. Then the longer things (pants, sheets, towels) can be hung on the wall-mounted racks.

I also love how compactly it folds.

We have someone in Japan to thank for this product. Thanks random Japanese company.

Kelly’s present

Anyone who knows me in person, knows that I make a big deal out of my birthday. I suspect some people think I make a big deal out of my birthday to extract presents out of people, but that’s not the purpose. I just like it being my day.

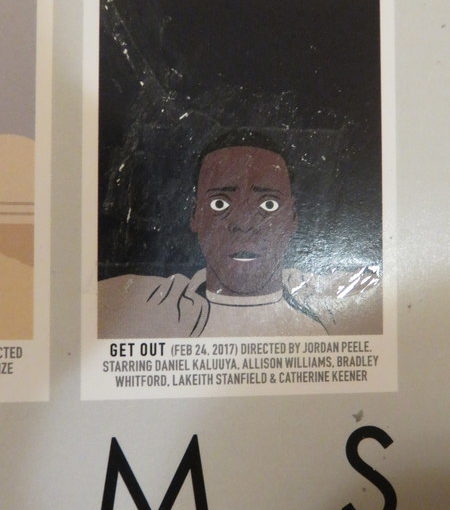

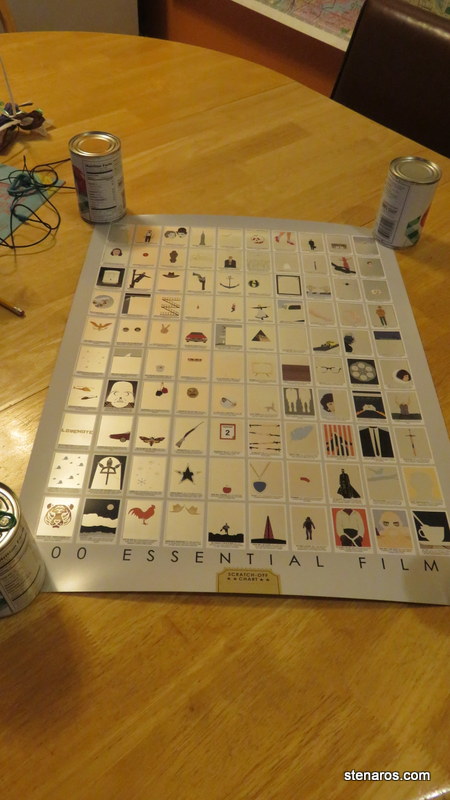

That said, look at the very cool present my friend Kelly got me! It’s a poster of 100 Essential Films, but it’s also a scratch off chart!

Look how shiny it is!

Look how shiny it is!

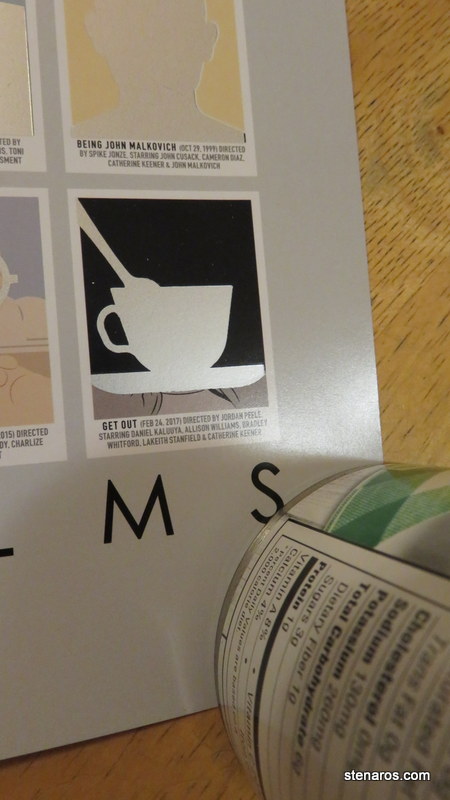

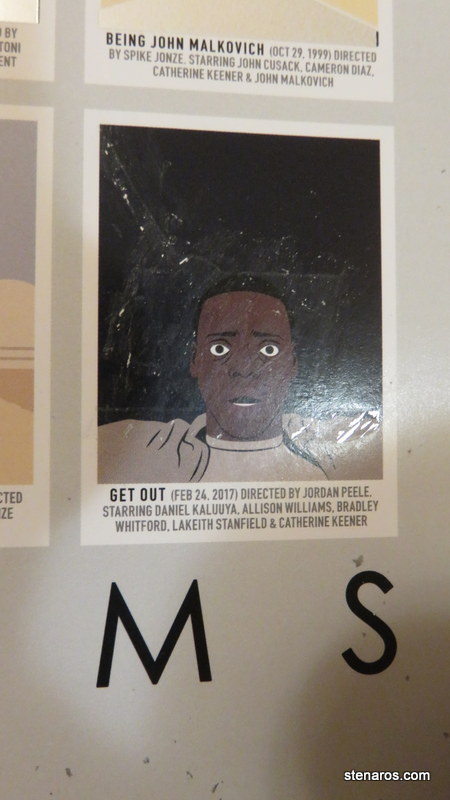

And here’s what’s cool. When the image is scratched off, it morphs into something else. Take the tea cup that is a big part of the film Get Out.

When scratched, it reveals the fact of Daniel Kaluuya. So fun! I have already seen 66 of 100 films. My plan is to watch a film on the list I haven’t seen, and scratch that one, plus two I’ve already seen. I look forward to working my way through this list.

I have already seen 66 of 100 films. My plan is to watch a film on the list I haven’t seen, and scratch that one, plus two I’ve already seen. I look forward to working my way through this list.

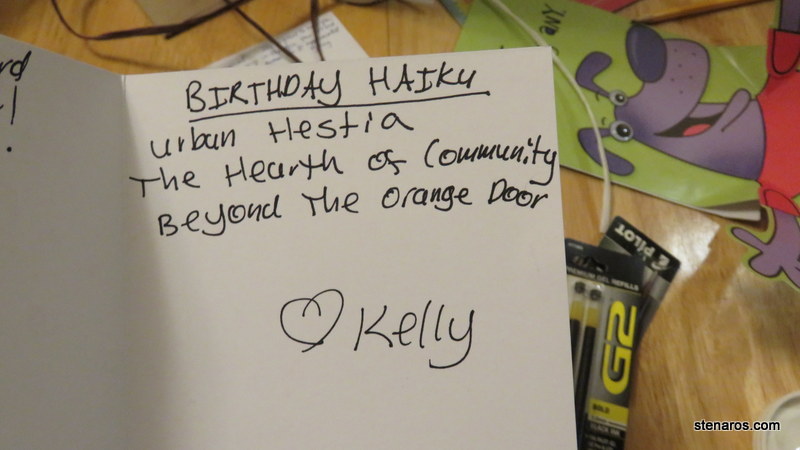

Kelly also always writes a birthday haiku. I found this one to be particularly sweet.

Thanks Kelly!

Thanks Kelly!

Birthday spoils

I had a good time celebrating my birthday with my family. Aside from checks, I also received these lovely items. Women’s World is a magazine my mother knows I love to hate. When I worked in the library during college, my boss bought a copy weekly, which I would read during my Friday night shift. Twenty years later, I continue to marvel that every single week they manage to have a cover with both a promise of rapid amounts of weight loss, and also a complex cake-like treat to make.

I had a good time celebrating my birthday with my family. Aside from checks, I also received these lovely items. Women’s World is a magazine my mother knows I love to hate. When I worked in the library during college, my boss bought a copy weekly, which I would read during my Friday night shift. Twenty years later, I continue to marvel that every single week they manage to have a cover with both a promise of rapid amounts of weight loss, and also a complex cake-like treat to make.

Most of my birthday money went to help meet my Payoff! goal, but stay tuned for the thing I did buy.

Keeping the vintage dress local

Early one Tuesday morning, I dropped books off at the library and continued on Denver Avenue. But wait! I screeched to a stop. Is that my dress on display in the window of an antique shop? I wheeled my bike over for another look.  It is! That lovely grey and pink lace covered dress was my go-to fancy dress for years. In fact, here’s a photo of me wearing it.

It is! That lovely grey and pink lace covered dress was my go-to fancy dress for years. In fact, here’s a photo of me wearing it.

Riding the rest of the way to work, I tried to remember what happened to it. I’m pretty sure I donated it to the Goodwill. But it’s made its way back to this vintage store. We’re keeping it in the Kenton neighborhood.

Thanks to my southern Idaho upbringing, I will always feel at home…

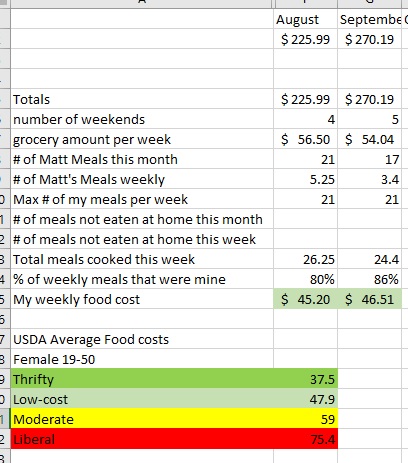

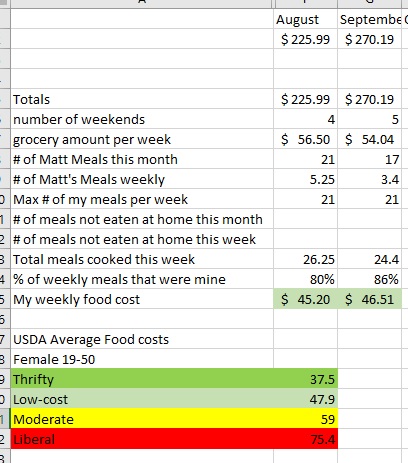

Challenge. Me, the food I eat, and the USDA Thrifty Food Plan

In looking for ways to send more of my money toward the payoff of my student loan, I’m going to focus on reducing my food costs in the last three months of 2017

There are many different ways to look at food costs. Some people lump their grocery and eating out budgets into one line. Some people look at the amount for the entire month, while others look at their food budget weekly. Some people even will break down each meal into a cost.

I have a couple of complicating factors in tracking my grocery bill. One has to do with the calendar. There are 30 days in some months, 31 in others. Some months have four weekends, some have five. Also, I make and sell meals to Matt. This came about because I needed a side job, and one of my skills is cooking. He has no desire to develop that skill in himself (thus far) and needed to reduce food costs. This has been great for both of us. For me, it’s easier to make recipes that feed more than one person. Plus, I get a little extra cash on the side. Matt gets a variety of nutritious food for less than he would pay eating out. I charge him $4.10 per meal.

A few years ago, I was searching the internet to find out what is a reasonable amount to spend on groceries. I discovered the USDA’s Food Plans. In a delightful bit of government minutia, food costs are tracked monthly and published on the USDA website. In one handy PDF document, you get food costs broken down by age, gender and family. Plus you can see the average cost under four USDA plans broken down weekly or monthly.

Example: For August 2017, a female between the ages of 19 and 50 would find the weekly/monthly Thrifty Food Plan costs to be $37.90/$164.20; the Low-Cost Plan to be $47.90/$207.50; the Moderate-Cost Plan to be $59.00/$255.80; and the Liberal Plan to be $75.40/$326.70. Note that these plans assume all meals and snacks for the week/month are prepared at home.

This is super cool and gives me a goal. Except, I also have to somehow reflect the fact that 4-6 meals worth of food per week go to a male between the ages of 19-50 years old (Thrifty food cost for that category is $42.80/$185.40). What to do, what to do?

I went back and crunched my grocery numbers from YNAB. There’s a whole spreadsheet, but I won’t make you read that. I’ll just sum up what I found.

First of all, I decided that the grocery shopping week begins on Saturday. I do my shopping on Saturday or Sunday. Thus, months that have five weekends, the total monthly food cost gets divided by 5. (Of course, October is the rare unicorn and begins on a Sunday, making things complex. I gave September 5 weekends, and October 4)

From April through September my average weekly food costs were $64.97 which puts me above the Moderate and below the Liberal Plan. Drat! Although August & September took a deep dive with $56.50 and $54.04 weekly totals.

But! Some of those food costs went to meals for the 19-50 year-old male. I don’t have data prior to August, but in August I sold Matt 21 meals and in September there were 17. (Vacation happened.)

I took the average number of Matt’s meals per week and added them to the total number of meals per week for me (7 days times 3 meals per day gives me 21 per week) giving me a total of 26.25 meals per week in August.

After that, I figured out what the weekly percentage was for my meals. In August that was 80%. Using that percentage, I could then calculate my actual average weekly meal costs. My total: $45.20 which puts me below the $47.90 Low-cost plan but not reaching the threshold of $37.90 Thrifty food plan.

I’ve realized there is a slight flaw in my data in that I don’t actually know how many meals I ate in the month. As mentioned before, vacation happened and the food budget for vacation happens outside of this grocery budget. I also don’t know how much I ate out in August, or September. Though my $40 eating out budget remained untouched all month (good job, me)a friend did buy me lunch for helping her with her resume. Plus work bought at least two lunches.

I have added lines to my spreadsheet so I can more accurately reflect the number of days I ate meals that I prepared.

My goal for October, November, December is to meet the Thrifty Plan Food costs while still eating a variety of delicious food with a lot of fruits and vegetables. I still plan to buy my red meat and poultry at New Seasons, which costs more, but I hope to offset that by doing the bulk of my shopping once per month at Winco (I have rediscovered the amazing deals) and cooking more with low-cost ingredients as well as using meat and cheese as flavor enhancers and not the main event. I will also figure out a way to better ascertain if Imperfect Produce is a good enough deal to keep going with.

Right now, I’m pleased that my grocery costs are in the Low-Cost range. But the monthly difference between the Low-Cost and Thrifty plans is $43.30. Over one year that is $519.60 that would be better off being paid toward my student loans.