Something about the angle of the autumn sun tends to make me very tired. But I did enjoy the way my shadow stretched for yards and yards as I was walking across the Broadway Bridge.

Tag: me

I return to Portland to find I’ve entered some sort of hell.

Having spent five lovely days in breezy Minneapolis, Minnesota I returned to Portland and found:

The Gorge was on fire. A teenager being irresponsible with fireworks started a fire that burned through large swaths of everyone’s favorite hiking destination. Multnomah Lodge was only saved due to an all-night battle by firefighters. I-84 was closed for more than a week, Hood River lost a chunk of their tourist season, towns had to evacuate, hikers were stranded overnight, and many people posted pictures of their favorite Columbia River Gorge sites on social media. The sorrow was immense.

Ash was everywhere. The Gorge isn’t far from our North Portland home, and there was a light dusting of ash in the fifth quadrant.

It was friggin hot. You know how when you’ve been having lovely cool summer experiences and you find yourself plunged into triple digit temperatures and it just doesn’t feel very good? That was Portland in the week after I got home.

My work computer was stolen. While I was enjoying my Jucy Lucy at Matt’s Bar, my office was being broken into by people who used the fire escape. They took two computers, a projector, and a favorite throw to wrap everything in. This meant that I spent my first day back at work with a brand new laptop, which had none of the same ports as my old laptop. So instead of working from three screens (one laptop, two monitors plugged in) I worked with one tiny laptop screen. It is very hard to do my job with one tiny laptop screen. Plus all of the installing of programs and getting everything up to speed.

It was probably the bumpiest re-entry I’ve experienced.

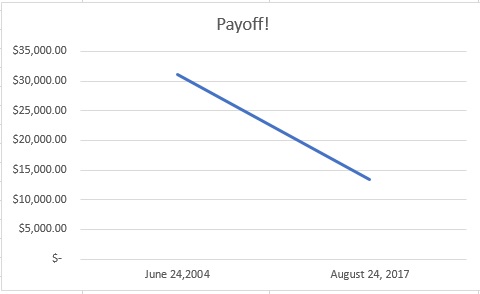

The Payoff! Plan

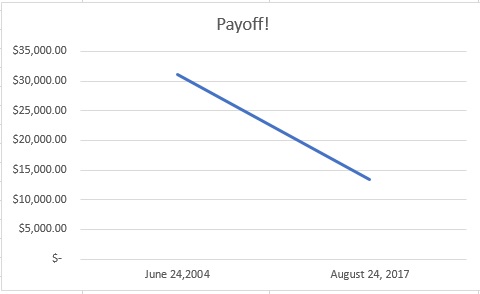

Back in 2003-2004, I borrowed $31,064.02 to attend graduate school. This was okay at the time, as I was following the conventional wisdom to not borrow for education more than your first year’s salary. The amount listed above was just under what my starting salary as a first-year teacher would have been.

But I didn’t get hired. I also didn’t substitute teach, which is the quickest path to becoming a teacher, outside of a weak job market (it wasn’t) and outright nepotism (I didn’t know anybody.)

Instead, I got a job as a secretary, which paid much less than that first-year teacher salary. My Secretary I job brought in a paltry $9.10 an hour. There is a lot to be said about why I made this decision, but that is not the focus of this essay. The consequence of my decision was that I signed up for the 20-year graduated repayment plan instead of the 10-year one. This means my expected payoff was scheduled for June 14, 2024.

In hindsight, when I switched jobs after a year an a half and got an $8000/year raise, I should have switched payment plans to the 10-year plan. But I did not. For many years, I trundled along paying just my monthly payment. Only since I’ve begun my new job have I been making extra payments.

As mentioned before, I’ve been reading a lot of Mr. Money Mustache. Yesterday, I encountered his post News Flash: Your Debt is an Emergency. This was the second time I’ve read this post, as it is also part of Start Here: Getting Rich from Zero to Hero in one Post. When I read the debt emergency post the first time, I nodded. Yesterday, when I re-read it, plus the linked post about the guy who paid off $90,000 of student debt in 10 months, something clicked and I’ve been reborn.

I’m putting all hands on deck to get rid of this debt.

My current balance as of today stands at $13,441.22. My current budget allows for my regular scheduled payment of $189.37, plus an extra payment of $180.00. My goal is to scrape off wherever I can to add to that extra payment.

I’m not going to go to the extreme measures the $90,000/10 months guy did. But I’m going to massively economize.

From now until this debt is paid off, I will report the following by the fifth of the month:

What I paid toward the loan the previous month

How much I paid toward the principal and how much toward the interest.*

Where the money for my extra payments came from.

A list of what I didn’t buy in order to put more money toward this project.**

Any roadblocks I’m having toward this goal.***

To get us started, here’s a quick Excel graph of my progress over 13 years.

*Here’s something I’ve already learned in the 25 minutes I’ve been doing this project: my extra payments aren’t going to the principal only. I will make it a priority to find out if I can change that.

**This is something the $90k/10mo guy did, and I like the idea.

***Right now one major road block I have is the number of friendships centered around socializing while purchasing food/drink. More on that later.

Our Total Eclipse, Salem, Oregon

Here’s what time we arrived in Salem. We left at 3:30. There was traffic all the way, but not significant slowing. Mostly my driving was in the 50 mph range.

In all my planning, I forgot to think about parking. Happily, we grabbed the last space in front of the State Library, paid for a full day of parking, and headed out to the capitol grounds. There we set up our space. There was one other group on the lawn when we arrived–it turns out we were there before the park opened. That was probably why all the other people were still hanging out at their cars. Then we both fell asleep.

Time stamp: 5:52 am

Matt’s sleeping setup.

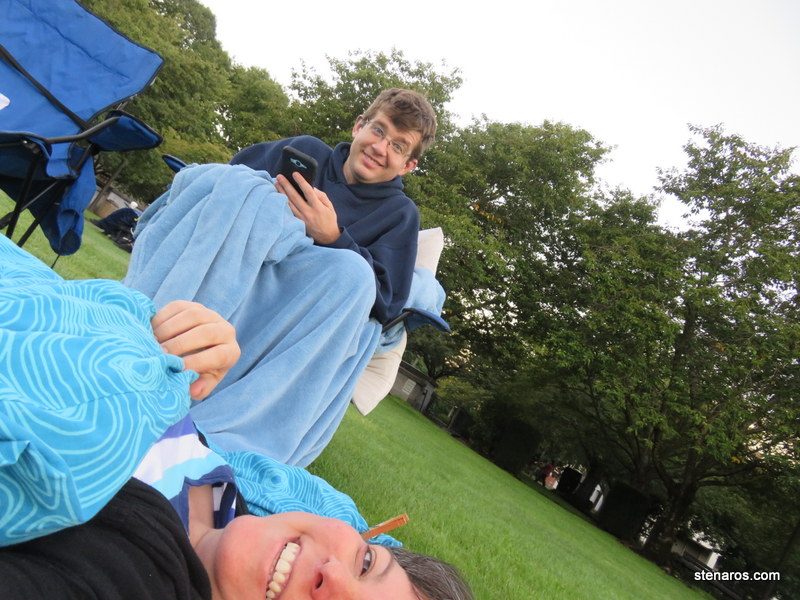

Here we are more awake. 6:27am.

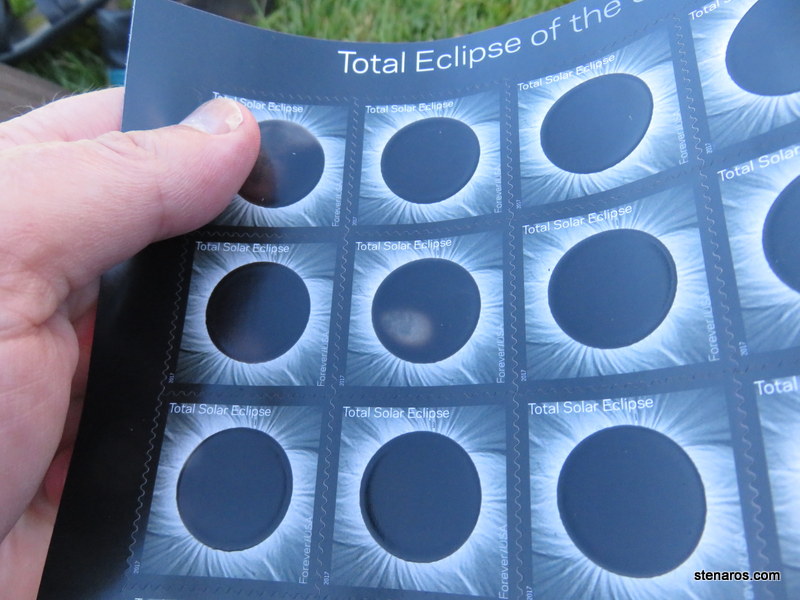

I made breakfast pizza for our trip. Breakfast pizza was AMAZING! Thanks, Cooks Illustrated for creating such a delightful concoction of ingredients. My work-mate mentioned that there would be a special postage cancellation at the capitol, so soon after the 8 am capitol opening time, I went in search of it. This is Helen, who not only works at the post office, but also designed the special cancellation. I bought commemorative envelopes from the gift shop and a sheet of eclipse stamps, plus some postcards and headed back outside to do some on-site corresponding. (Sadly, I took pictures of none of this, not the many postcards, or the special envelopes, or the special cancellation.) You can do a Google Image search though, which is more fun, because you get to see cancellations from across the country.

My work-mate mentioned that there would be a special postage cancellation at the capitol, so soon after the 8 am capitol opening time, I went in search of it. This is Helen, who not only works at the post office, but also designed the special cancellation. I bought commemorative envelopes from the gift shop and a sheet of eclipse stamps, plus some postcards and headed back outside to do some on-site corresponding. (Sadly, I took pictures of none of this, not the many postcards, or the special envelopes, or the special cancellation.) You can do a Google Image search though, which is more fun, because you get to see cancellations from across the country.

Look at these amazing stamps! They change color when you apply heat!

I also couldn’t resist the pressed penny machine.

Here we are in our glasses. 9:09 am. The eclipse has begun! When you put on those glasses, everything went black, except the sun. Hence the not-great framing. Notice how many more people are around us. They kept coming.

These two were among my favorite of our neighbors. While most people, myself included, would put on the glasses and then take them off, look around, do other stuff (write letters, postcards) and then check back in with how the eclipse was going, these two put on their glasses and kept them on.

The stamps in the sun!

Our nearest eclipse neighbor to the left. He had a lot of cameras going. There were a lot of cameras in general. The fountain in the background came on early in the morning. Overheard: “I work at the capitol, and that fountain is never on!”

My favorite young viewer.

Improvising filters for the phone cameras. 10:03am.

And then it got colder and colder. I put my sweater back on. And then it was dark. Total eclipse. These are photos I took on my normal camera on the auto setting with no filter. I zoomed and pushed the shutter button. I’m thrilled they came out so well. 10:18 am.

The cold was surprising to me. Also surprising was how it didn’t really get dark. This is mid-eclipse. It was more of a dusk, than of a midnight thing.

Back to the sun/moon thing.

What it looked like without zooming.

So many cameras!

I think this one is my favorite.

Totality is over. Seeing the huge difference between 99% and 100%, I was very glad we made the journey.

Time stamp: 10:29 am. I was very surprised how soon after totality people packed up and left. There was still another hour of eclipse. Ten minutes prior, this was full of people. My work colleague was among the early leavers. It took her only two hours to get home. This was a far shorter trip than we had.

Some eclipse supplies.

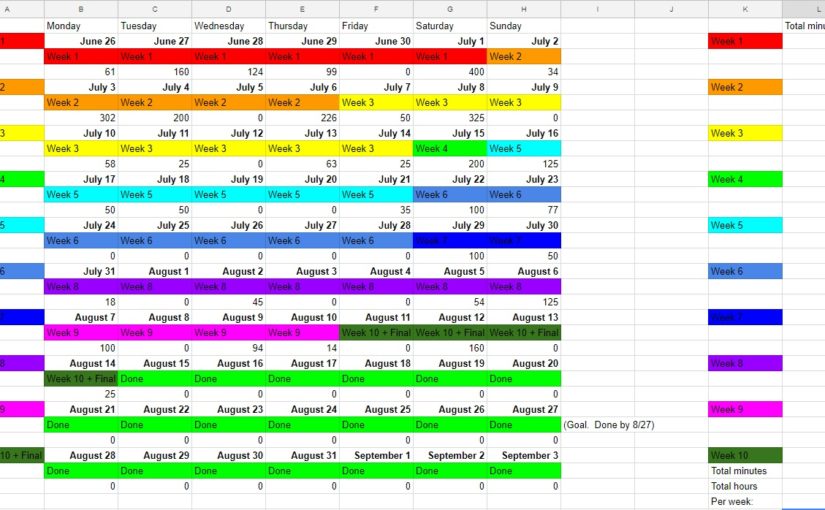

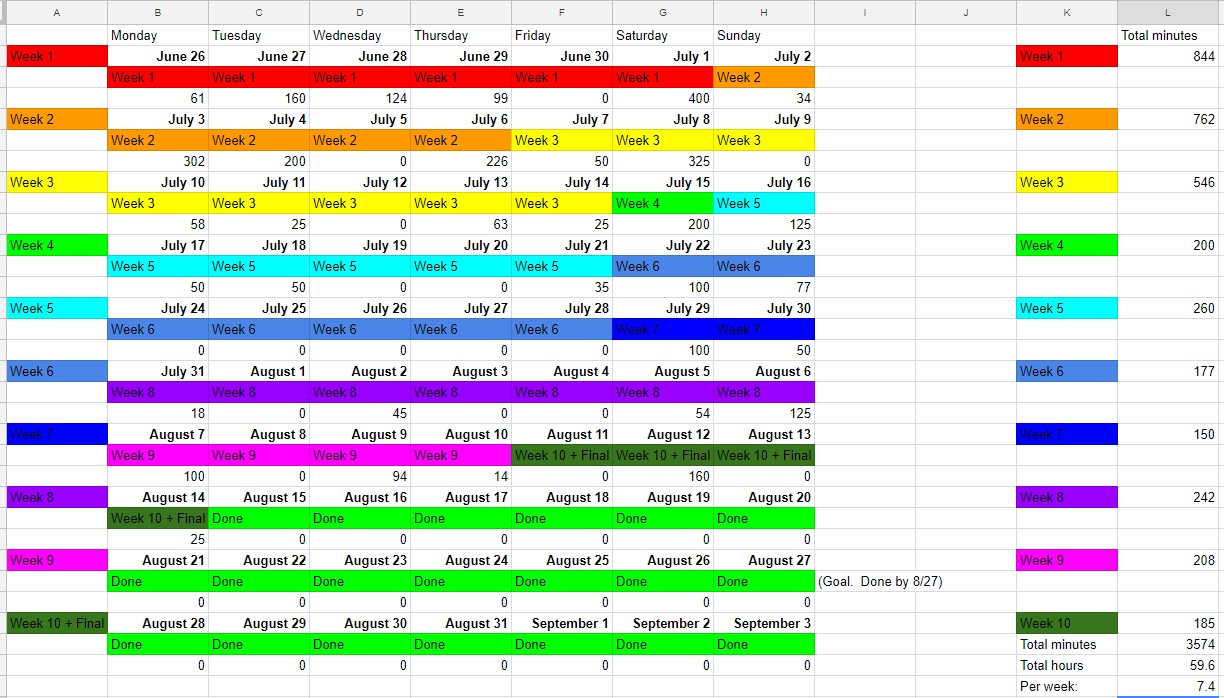

Class plan, completed.

I’m quite proud of my colorful tracker for my Grammar Lab class progress. My early goal was to do each week of classwork in six days, rather than seven. I used colors to keep track of how I was doing. You can see how things progressed.

One thing I wasn’t counting on was that the class would become easier as it went on. Thus, I spent 200 minutes on July 15–at that point a normal amount of daily work–on Week 4 and was surprised to discover that I had finished all the week’s activities in one sitting. From that point on, all weeks took less than 300 minutes to complete. Phew!

And I also feel quite gleeful at finishing nearly three weeks early. That gives me a nice chunk of summer without classwork.

Essay: Mr Money Mustache has rejuvenated my life

Along with being busy with many various and sundry things, I keep a close eye on my money. I grew up without a sense of abundance around money–though we were solidly middle class–and while I’ve had off and on times of cultivating feelings of abundance around money, I do worry about having enough. “Enough” being defined specifically as enough to live comfortably now while also saving enough to keep me from eating cat food in my dotage.

There was a time in my 20s when I would regularly check out the library’s 332.024 call number, which is the personal finance section. A friend, seeing my interest in money, gave me the book Your Money or Your Life when I was 26 and I applied those principles for the next decade or so.

I’ve slacked off over the last few years. In 2015 I took a pay hit when I left my job of nine years. My justification was that taking a reduced salary (which also gave me summers off) would result in many more opportunities within the organization in the future. It turned out to be a bad gamble. After a few months of observing the organization, I concluded I wouldn’t want to work there for another few months, much less for the rest of my career.

Happily, the job hunt was brief and successful, and I landed a new position where the salary exceeded my job-of-nine-years salary.* I received two raises the first year, boosting my salary to its highest level, ever.

(*Though actually, due to the 32-hour week and 7 weeks vacation at the job of nine years, I was making less money at the new job. I knew that once I left that particular job it would be very hard to equal the pay/benefits ratio.)

This new position fits me well, and I’m happy to have the job. O! But I miss the days and days of time off I used to have. It turns out that what was fueling my many projects over the years, was being supported by having enough time to do the projects. And I didn’t just have time for the projects. I had time to read a ton and goof off and not get a lot of things done too. Now, working 40 hours per week, not even having ALL the federal holidays off, it seemed like there wasn’t any time left for rebuilding the planter box out front or painting the back doors where the painters declined to finish the job. I had even solicited names of handymen to rebuild said planter box. Because when you barely have time to get the laundry/grocery shopping/cooking done, how can you even think of finding time to do the fix-it things?

Then, two things happened in quick succession. The first was that I took an online class this summer. It took up time. The first three weeks, in particular, took up 12-14 hours per week. After that, things settled back to 3-4 hours per week, but I noticed that even during the weeks that took the most hours, I had time to finish all my assignments. Could that time be applied to other things?

The second was a link in the YNAB newsletter. YNAB is the budgeting program I use to manage my money. They are very good at helping people get an understanding of the money coming in, and how to allocate for your priorities. Their newsletter is full of stories of people who paid off gobs of debt in small amounts of time, or people who saved for the exact vacation they had dreamed of. One week, there was a link to an older post by Mr. Money Mustache about appreciating the work you’d done to grow you ‘stache. And to enjoy life.

Who was Mr. Money Mustache, and what was this ‘stache to which he referred? Happily, there was a “start here” post.

I started.

Mr. Money Mustache (MMM) is the online persona of a former tech worker who through his 20s saved large amounts of his large tech salary and “retired” by the time he was 31. He believes in saving much more of your money than spending it, in reducing your consumption of many things and of not wasting your time on things that aren’t worth your money. He also believes in both “insourcing” as much of your life as possible, and living in frugal luxury.

He’s funny, swears a lot, and also suggests a good punch in the face, often self-applied. (In one of my favorite “punch you in the face” posts, he discovered that Mister Money, a check cashing firm, had opened in his town. Aghast that people who don’t have any idea what they spend in the first place would go to Mister Money and pay a $15.00 fee for a payday “loan” he contemplated opening a competing store next door where people would give him $15.00 and he would punch them in the face and not take the payday loan.)

Mr. Money Mustache writes a lot of things that elicit a reaction of, “Nuh-uh” for the general population. Never buy a car using a loan, bike everywhere, hang your clothes to dry, save 75% of your pay, stop buying stuff. Stop buying most everything.

There’s a part of me (MMM would call it the complainypants part of me) that has the same whiny response. I don’t have a tech worker’s salary! 75% of my pay isn’t enough to live on! It’s hard to bike everywhere, especially when it’s rainy! Clothes take forever to dry if you hang them in the winter! Sometimes I like to buy stuff!

But even as these thoughts were crawling through my head, I there was a louder drumbeat:

Mr. Money Mustache is your people!

And that voice was right. While I still live a fairly frugal existence–cooking my food, riding public transit to work, buying a lot of my clothing second hand–over the past winter, I noticed a small voice asking where was that person who biked a lot of places, got excited about projects and got stuff done? Where was the person excited about anything?

Reading Mr Money Mustache posts feels like a shot of the best “early-rising-farmer energy” the kind that usually kicks in around May every year and lasts through the summer. That energy boost didn’t happen this in May, and I wondered if it would come at all. It turned out what I needed was a good talking to from MMM.

I’m already set up for the MMM lifestyle. Laundry? I bought a really nice outdoor clothes dryer years ago. Plus I have two in my bedroom for when it gets raining again. Biking? My bike is tricked out for all sorts of errand running. I don’t even need a bike trailer for most stuff. Saving money? I’m crazy good at it. When I looked at my budget 40% of my net pay is already going either to my retirement accounts, or to speed up debt repayment. Not buying stuff? I’ve got some room to improve there–just last weekend, even after reading MMM, I spent almost $50 on window washing gear–but I’m game to try.

And guess what? If I found 3+ hours per week to study and do my classwork, you bet I can find time do some projects. And I love doing projects. I love to plan projects, and I love to work on projects, and I love having done projects. (Finishing them is not my favorite thing). My house is full of cool stuff that wouldn’t be there unless I (and whomever I roped into helping me) hadn’t done the projects. And my house is just waiting to be cooler than it was because there are still projects to do.

Am I biking EVERYWHERE? No, not right at the moment. My work pays for a transportation pass for me, and I don’t love that bike to work, so for now I’m keeping my commute the same delightful (and free!) experience it is. But I did get out a compass and draw a circle on my the big map in my living room that shows me one mile journey in every direction from my house. I’ll start by biking to all of those places and make the circle bigger as I get my biking muscles back.

Am I saving MOST ALL of my paychecks? No, but I’m keeping a much better eye on what I spend, and I’m excited to finally do the project where I find out how what the best price for the food staples I use really is.** I’m also looking into some side jobs that can bring in extra cash.

(**I really want someone to build me an app for this. Here’s what I’m looking for. A way to list all my staples: brown rice–long grain, pinto beans, peanut butter, apples, etc. A way to be in the store, and to quickly find a particular staple on the app. When I find it, it will show me the average price I pay, the lowest price I’ve paid in the last (specific amount of time) and the price I paid the last time I bought it. I would also like to have a desktop interface, so I can type the newest data on something besides my phone. If you build me this, please let me know you have done this. In the meantime, I’m going to make a Google sheet. So unfancy! I would pay up to $5.00 for a no-ad app.)

Am I thinking of doing a big landscaping project–one that will bring much daily joy to me after it’s finished, as well as adding curb appeal–armed with only my wits, books from the library, the tools I already own and the willing help of the boyfriend? Why yes I am, and I know that Mr. Money Mustache would be proud.

Will I be able to save enough to retire in 10 years, at 52? Maybe. But regardless, I don’t feel so hopeless about working until 70. Because I’ve got the skillz to get the savings in order long before that. I’ve spent all of my adult life honing them. I just needed Mr. Money Mustache to remind me.

Why let ten-cent increments of money get away from me? The BottleDrop Green Bag program

A few things came together recently. One is that my company did some work for OBRC, and I learned of the existence of the Green Bag program. The second is that the bottle deposit rate went from five cents to ten cents. (Since 1971, if it had kept up with inflation, it would be around $0.25 now). Plus, Matt started drinking Propel, which is water with something in it. Also, my company started providing bottled kobucha for its employees. That also has a bottle deposit on it.*

Thus, I started looking at five kombucha bottles in the work recycling bin and thinking, “That’s like fifty cents. That’s real money.” In junior high, when we were introduced to the magic of vending machines (also known as: FuSESKiJuK Funding School “Extras” by Selling Kids Junk Food) candy bars were fifty cents and thus forever more fifty cents will always be my “real money” threshold.

There’s a lot not to like about redeeming bottles. For me, the number one thing is the smell. I’m not a hugely smell-sensitive person, but the combination of elderly beer/soda dregs really turns my stomach. Plus, there’s the time it takes to actually redeeming, which is another step in my very full days.

Happily, the Green Bag Program exists. For this program, you visit a BottleDrop center, open an account, and purchase 15 bags for $1.50. Then, you fill them and drop them off at any BottleDrop center. You don’t even have to go inside. They have an outside drop place that can be accessed before and after hours by using your card. Then, employees at the center redeem the bottles and cans for you and credit your account. This costs $0.25. So for $0.40 (four bottles) I can avoid most of the problems I have with redeeming. Plus, if you cash in your credit at specific stores (Fred Meyer is one) you get $0.12 per bottle and not $0.10.

I’m excited about this program, especially because I’m collecting bottle redemptions on items I haven’t paid the deposit on. It’s free money for me!

*It turns out that kombucha has been ruled “juice” and thus should not have a deposit on it.** I’ll keep collecting those bottles until the label changes and I can’t redeem them any longer.

**The weirdness of what does and does not have a bottle deposit bugs me.

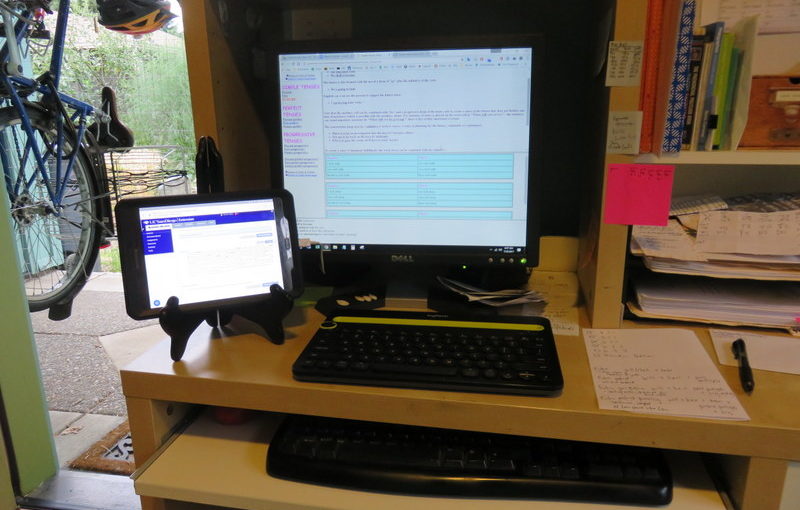

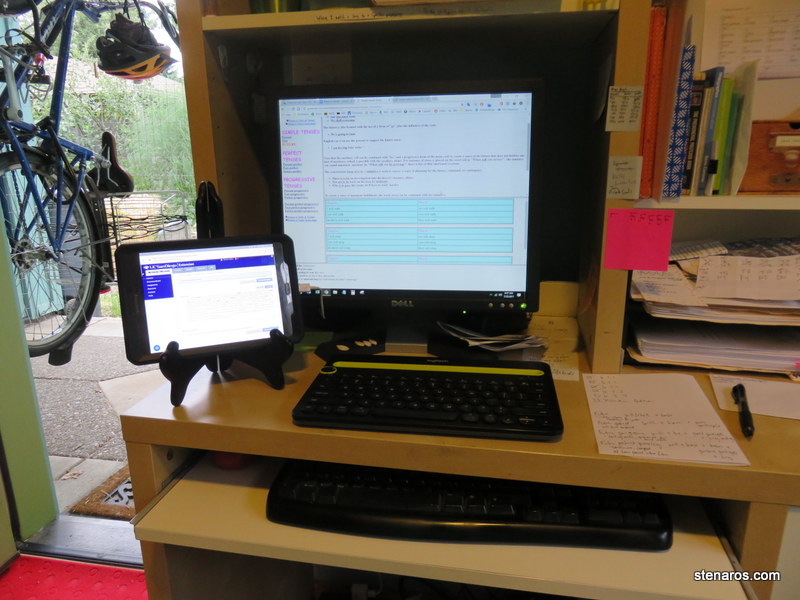

Employing all the devices

I’ve been busy this summer with the class Grammar Lab, which is taught by the UC San Diego Extension Service. It’s class number one (of four) in a copyediting (or possibly copy editing–the term is spelled both ways) certificate. *

Though it very clearly stated when registering that this is NOT a learn-as-you-go class, it turned out to be just that. The 10-week series was loaded on the first date and the instructor said things had to be done by the end date. He recommended not getting very far behind.

This was great news to me as I had a vacation scheduled during Week 10, and I prefer to vacation during my vacations, not work on schoolwork. After the first three weeks (which were killer) it got easier, so I’ve got a plan to work ahead and finish a week early.

The class requires taking multiple quizzes per week and one can use notes and other helping devices. To save flipping between windows, I’ve started utilizing both my tablet and desktop computer. The quizzes go on the tablet, where I’m able to type using my wireless keyboard. Then I can look at my notes and online resources as I go using my desktop computer.

Speaking of online grammar resources, the internet is very generous in this area. It’s as though the grammar people would like nothing better than for you to be properly able to use grammar correctly. I’ve enjoyed Grammar Bytes for both its content and aesthetics, but the most helpful site for me this summer is the Guide to Grammar and Writing. On this site you will be charmed (or repelled) by the early web page layout, but you will be incredibly appreciative of the clarity and volume of information. The guide to tenses alone saved my bacon repeatedly.

*And now that I’ve officially announced that I want to be an official copy editing-type person, all of the many mistakes contained in this blog look that much more terrible. I hang my head in shame.

When you spy your phone cover in a different format

See that? That’s the same pattern as my phone cover. It was like when someone walks by wearing a dress you also own. So weird!

See that? That’s the same pattern as my phone cover. It was like when someone walks by wearing a dress you also own. So weird!

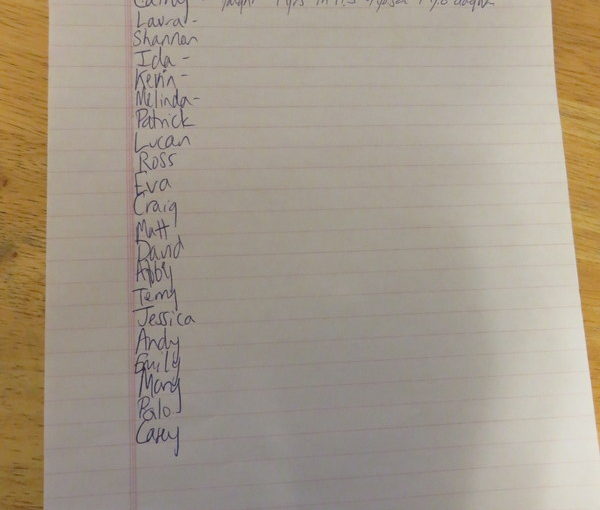

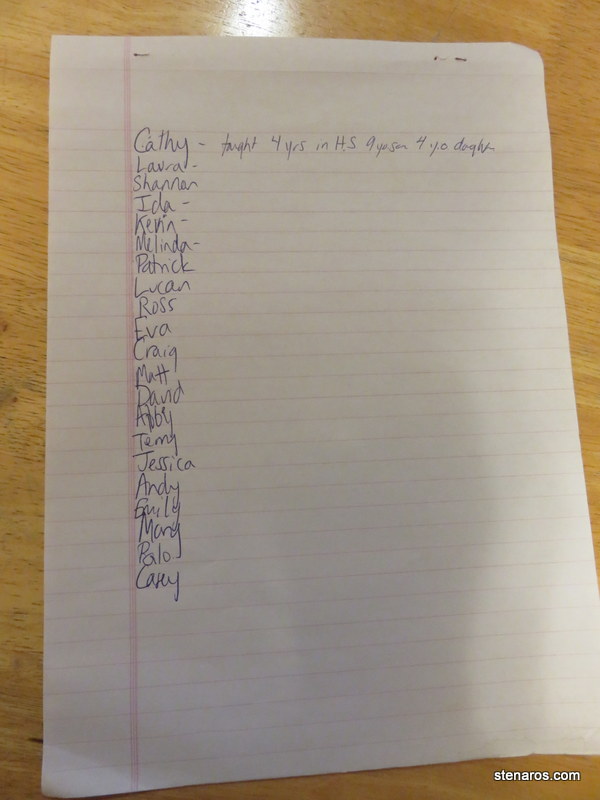

Found in notepad

I didn’t have a notebook and needed one for the conference I was attending. I grabbed an old notepad and ripped out some page so as to make my own smaller pages. And here was a list of classmates. I can tell by the presence of the name Abby, that this is from one of my Middle School Math Certificate classes. I used to make a list of names on the first day, and then quiz myself before every class. That way, when I needed to point out that Ida had a good point, I could just say, “Ida has a good point,” rather than, “I agree with her.” [waves vaguely in the direction of Ida]

People marveled over how I learned everyone’s name, but it wasn’t hard. They mostly sat in the same order each week. And learning names quickly is an important skill for a teacher to have.